Troy83

No content yet

Troy83

🚀 Ethereum outshines Bitcoin in weekend rally

Spot ETH ETFs in the US have attracted $6.7B net inflows YTD, with late July seeing a record $2.4B in 6 days, far surpassing BTC ETFs’ $827M. This surge reflects strong institutional demand and capital rotation from BTC to ETH.

On Monday Asia session, ETH jumped 2.9% to break $4,300, its highest since Dec 2021, and is up 20% in the past week. Bitcoin also crossed $121K, nearing its all-time high.

Corporate treasuries are playing a bigger role: US-listed companies now hold ~$13B ETH, with over $1.5B purchased in just the past month — echoing the ea

Spot ETH ETFs in the US have attracted $6.7B net inflows YTD, with late July seeing a record $2.4B in 6 days, far surpassing BTC ETFs’ $827M. This surge reflects strong institutional demand and capital rotation from BTC to ETH.

On Monday Asia session, ETH jumped 2.9% to break $4,300, its highest since Dec 2021, and is up 20% in the past week. Bitcoin also crossed $121K, nearing its all-time high.

Corporate treasuries are playing a bigger role: US-listed companies now hold ~$13B ETH, with over $1.5B purchased in just the past month — echoing the ea

- Reward

- like

- Comment

- Repost

- Share

🇺🇸 Today's Crypto News:

Vitalik Buterin has officially returned to the status of "onchain billionaire" as the price of ETH surpassed $4.2K, reaching a peak of $4,332 — the highest level since 12/2024. Vitalik's wallet holds 240,042 ETH (~$1.04B) along with some other altcoins.

Bo Hines, the Director of the White House Crypto Council, announced his resignation, returning to the private sector but will continue to advocate for digital assets.

World Liberty Financial, a crypto project backed by the Trump family, is considering establishing a $1.5B Nasdaq-listed company to hold WLFI tokens, join

View OriginalVitalik Buterin has officially returned to the status of "onchain billionaire" as the price of ETH surpassed $4.2K, reaching a peak of $4,332 — the highest level since 12/2024. Vitalik's wallet holds 240,042 ETH (~$1.04B) along with some other altcoins.

Bo Hines, the Director of the White House Crypto Council, announced his resignation, returning to the private sector but will continue to advocate for digital assets.

World Liberty Financial, a crypto project backed by the Trump family, is considering establishing a $1.5B Nasdaq-listed company to hold WLFI tokens, join

- Reward

- like

- Comment

- Repost

- Share

🚨 Vitalik Buterin is back as an onchain billionaire! 🚀

Now holds 240,042 ETH (~$1.04B) as ETH surges past $4.2K.

ETH hit $4,332 — less than 13% away from its $4,878 ATH (Nov 2021).

U.S. spot ETH ETFs saw $326.6M in net inflows over the past 5 days, beating BTC ETFs ($253.2M).

A push to $4.5K could liquidate $1.35B in short positions, fueling a potential short squeeze.

Many traders believe a new ATH is just days away.

📈 ETH’s rally is being powered by strong ETF demand and bullish momentum ahead of what could be the cycle’s peak.

#Ethereum # ETH #Vitalik # Crypto #BullRun # ETF #OnchainBilliona

Now holds 240,042 ETH (~$1.04B) as ETH surges past $4.2K.

ETH hit $4,332 — less than 13% away from its $4,878 ATH (Nov 2021).

U.S. spot ETH ETFs saw $326.6M in net inflows over the past 5 days, beating BTC ETFs ($253.2M).

A push to $4.5K could liquidate $1.35B in short positions, fueling a potential short squeeze.

Many traders believe a new ATH is just days away.

📈 ETH’s rally is being powered by strong ETF demand and bullish momentum ahead of what could be the cycle’s peak.

#Ethereum # ETH #Vitalik # Crypto #BullRun # ETF #OnchainBilliona

- Reward

- 1

- Comment

- Repost

- Share

Web3 Weekly Highlights (Aug 3–9, 2025) 📰

Regulation: Trump signs EO allowing 401(k) to invest in crypto — $8.7T pool, even 1% inflow = ~$87B. BTC miners rush shipments pre-tariff hike.

People: Circle CEO Jeremy Allaire’s 3 uncanny tech bets; Bitwise CIO spots 3 ETH & L1 opportunities; Pantera’s 1000x BTC fund; Saylor aims debt-free BTC strategy.

Projects: Pendle’s ve-tokenomics shine; Tether plans US-only USDT; Linea’s mysterious “42” hint; Galaxy eyes tokenizing its stock.

Insights: Altcoins slump while Wall Street takes over; Pantera crypto salary report; Cambodia’s Huione = $80B crime hub;

Regulation: Trump signs EO allowing 401(k) to invest in crypto — $8.7T pool, even 1% inflow = ~$87B. BTC miners rush shipments pre-tariff hike.

People: Circle CEO Jeremy Allaire’s 3 uncanny tech bets; Bitwise CIO spots 3 ETH & L1 opportunities; Pantera’s 1000x BTC fund; Saylor aims debt-free BTC strategy.

Projects: Pendle’s ve-tokenomics shine; Tether plans US-only USDT; Linea’s mysterious “42” hint; Galaxy eyes tokenizing its stock.

Insights: Altcoins slump while Wall Street takes over; Pantera crypto salary report; Cambodia’s Huione = $80B crime hub;

- Reward

- like

- Comment

- Repost

- Share

The Onchain Aggregator War Has Begun ⚔️

In Web3, two giants are taking radically different paths to control the flow of value:

🔵 Jupiter wants to own the interface. It's turning itself into Solana’s default liquidity gateway — aggregating trades, owning user relationships, acquiring apps (Moonshot, DRiP), and embedding itself into wallets and dApps. It’s building the "Amazon of DeFi".

🔴 Hyperliquid wants to own the backend. It offers deep, low-latency order books and lets others build on top. Phantom, BasedApp, and others rely on its liquidity rails. It's becoming DeFi’s "AWS".

➡️ This isn’t

In Web3, two giants are taking radically different paths to control the flow of value:

🔵 Jupiter wants to own the interface. It's turning itself into Solana’s default liquidity gateway — aggregating trades, owning user relationships, acquiring apps (Moonshot, DRiP), and embedding itself into wallets and dApps. It’s building the "Amazon of DeFi".

🔴 Hyperliquid wants to own the backend. It offers deep, low-latency order books and lets others build on top. Phantom, BasedApp, and others rely on its liquidity rails. It's becoming DeFi’s "AWS".

➡️ This isn’t

- Reward

- like

- Comment

- Repost

- Share

🚨 2024 Crypto Compensation Report

📊 Key takeaways from 1,600+ responses:

Crypto payroll is booming: 9.6% now receive part or all of their salary in crypto—up 3x YoY. USDC leads (63%), followed by USDT (28.6%).

Remote still rules: 82% work fully remote, though in-office work is up from 1.5% → 6%, signaling a slow shift.

Engineering talent in demand:

- Junior dev salaries up +25.6% YoY

- Mid-level up +14.5%

- Senior devs still lead with median $202.5k

Degrees ≠ higher pay:

-Bachelor’s holders earn more on average than Master’s or even PhDs

- MBAs? No salary boost in Web3

Women > Men in some ro

📊 Key takeaways from 1,600+ responses:

Crypto payroll is booming: 9.6% now receive part or all of their salary in crypto—up 3x YoY. USDC leads (63%), followed by USDT (28.6%).

Remote still rules: 82% work fully remote, though in-office work is up from 1.5% → 6%, signaling a slow shift.

Engineering talent in demand:

- Junior dev salaries up +25.6% YoY

- Mid-level up +14.5%

- Senior devs still lead with median $202.5k

Degrees ≠ higher pay:

-Bachelor’s holders earn more on average than Master’s or even PhDs

- MBAs? No salary boost in Web3

Women > Men in some ro

- Reward

- like

- Comment

- Repost

- Share

🔁 Could stablecoins drive the next decade of global economic growth—just like e-payments once did?

Stablecoins aren’t just for payments anymore. They’re accelerating the velocity of money by making capital move faster, work harder, and reach further.

💡 With 24/7 global liquidity, programmable settlement, and permissionless USD access, stablecoins are:

- Powering remittances & cross-border B2B

- Fueling DeFi & real-world payments

- Boosting financial inclusion in emerging markets

📈 Short-term: More efficient capital circulation → higher GDP & productivity

🏗️ Long-term: From speed to capital

Stablecoins aren’t just for payments anymore. They’re accelerating the velocity of money by making capital move faster, work harder, and reach further.

💡 With 24/7 global liquidity, programmable settlement, and permissionless USD access, stablecoins are:

- Powering remittances & cross-border B2B

- Fueling DeFi & real-world payments

- Boosting financial inclusion in emerging markets

📈 Short-term: More efficient capital circulation → higher GDP & productivity

🏗️ Long-term: From speed to capital

- Reward

- like

- Comment

- Repost

- Share

We’re living in the age of hyper-speculative capitalism 💸📈

Markets no longer reflect fundamentals like earnings or GDP — instead, they follow liquidity flows.

Global M2 remains elevated, and Bitcoin 🚀 thrives in this environment.

Based on past halving cycles, BTC could peak at $135K–150K around late September 2025.

Despite 5% rates and a strong job market, the US is running a 7% GDP deficit. Fiscal policy now dominates.

In this distorted economy, liquidity is the market.

Ignore it at your own risk.

#Bitcoin # Macro #Crypto # Liquidity

Markets no longer reflect fundamentals like earnings or GDP — instead, they follow liquidity flows.

Global M2 remains elevated, and Bitcoin 🚀 thrives in this environment.

Based on past halving cycles, BTC could peak at $135K–150K around late September 2025.

Despite 5% rates and a strong job market, the US is running a 7% GDP deficit. Fiscal policy now dominates.

In this distorted economy, liquidity is the market.

Ignore it at your own risk.

#Bitcoin # Macro #Crypto # Liquidity

- Reward

- like

- Comment

- Repost

- Share

📈 Bitcoin treasury companies like MicroStrategy & Metaplanet are accelerating BTC’s journey to becoming a global reserve asset.

💰 Many institutional funds can't buy spot BTC due to restrictions—but they can buy BTC-backed stocks or bonds. Treasury companies bridge that gap.

🏦 With access to long-term corporate debt, these firms use smart leverage—safer than margin or daily-reset ETFs.

⚡ This isn’t a threat to Bitcoin’s ethos—it’s part of its natural adoption curve.

🌍 BTC remains open, permissionless, and self-custodial. Corporate adoption simply reflects rising global demand.

🔑 Bitcoin is

💰 Many institutional funds can't buy spot BTC due to restrictions—but they can buy BTC-backed stocks or bonds. Treasury companies bridge that gap.

🏦 With access to long-term corporate debt, these firms use smart leverage—safer than margin or daily-reset ETFs.

⚡ This isn’t a threat to Bitcoin’s ethos—it’s part of its natural adoption curve.

🌍 BTC remains open, permissionless, and self-custodial. Corporate adoption simply reflects rising global demand.

🔑 Bitcoin is

- Reward

- like

- Comment

- Repost

- Share

🎯 How Michael Saylor's Bitcoin Strategy Avoids Liquidation

Since 2020, Michael Saylor has built MicroStrategy into a Bitcoin powerhouse — holding 628,791 BTC ($71.9B) without relying on risky leverage.

Now, he’s taking it further:

- Phasing out convertible debt

- Switching to preferred equity (like the new STRC offering targeting 10% yield)

- Redeeming $4.2B in bonds to avoid short pressure from hedge funds

- Saylor avoids margin calls by using equity over debt. Few can follow — most crypto funds rely on convertibles or private placements.

In a sea of leverage, Strategy stands alone. 🧠📈

#B

Since 2020, Michael Saylor has built MicroStrategy into a Bitcoin powerhouse — holding 628,791 BTC ($71.9B) without relying on risky leverage.

Now, he’s taking it further:

- Phasing out convertible debt

- Switching to preferred equity (like the new STRC offering targeting 10% yield)

- Redeeming $4.2B in bonds to avoid short pressure from hedge funds

- Saylor avoids margin calls by using equity over debt. Few can follow — most crypto funds rely on convertibles or private placements.

In a sea of leverage, Strategy stands alone. 🧠📈

#B

BTC0.99%

- Reward

- like

- Comment

- Repost

- Share

🚀 Crypto Trading in 2025 Just Got Smarter with ChatGPT Agent

AI is no longer just a tool — it's your co-pilot. The new ChatGPT Agent for crypto trading helps investors and traders automate every part of their workflow:

1️⃣ Real-time Research: Summarizes news, blockchain data, and on-chain signals instantly.

2️⃣ Charting & Analysis: Generates custom technical charts, pattern alerts, and sentiment summaries.

3️⃣ Automated Trading Support: Executes trades via API (only with human approval), tracks positions, and optimizes risk exposure.

4️⃣ Custom Dashboards: Build and visualize your portfolio,

AI is no longer just a tool — it's your co-pilot. The new ChatGPT Agent for crypto trading helps investors and traders automate every part of their workflow:

1️⃣ Real-time Research: Summarizes news, blockchain data, and on-chain signals instantly.

2️⃣ Charting & Analysis: Generates custom technical charts, pattern alerts, and sentiment summaries.

3️⃣ Automated Trading Support: Executes trades via API (only with human approval), tracks positions, and optimizes risk exposure.

4️⃣ Custom Dashboards: Build and visualize your portfolio,

- Reward

- like

- Comment

- Repost

- Share

🇨🇳 China is playing the long game with crypto.

Instead of just holding reserves like the US, Beijing is injecting confiscated crypto liquidity into Hong Kong exchanges — turning HK into a global price discovery hub.

💡 This isn't just about FATF compliance — it’s a strategic move: control supply, steer prices, lead the market.

⚖️ The US is tied to a "hold-and-wait" strategy, lacking flexibility in response.

💥 Liquidity is power. China has chosen Hong Kong as the game board — and they’re making the rules.

#crypto # China #HongKong # Bitcoin #Web3 # Geopolitics #LiquidityWar # BTC #Altcoin # DeFi

Instead of just holding reserves like the US, Beijing is injecting confiscated crypto liquidity into Hong Kong exchanges — turning HK into a global price discovery hub.

💡 This isn't just about FATF compliance — it’s a strategic move: control supply, steer prices, lead the market.

⚖️ The US is tied to a "hold-and-wait" strategy, lacking flexibility in response.

💥 Liquidity is power. China has chosen Hong Kong as the game board — and they’re making the rules.

#crypto # China #HongKong # Bitcoin #Web3 # Geopolitics #LiquidityWar # BTC #Altcoin # DeFi

- Reward

- like

- Comment

- Repost

- Share

🚀 This Week in Web3 – Must-Know Highlights from Asia to Wall Street

1️⃣ Ethereum Turns 10

- $ETH grew 3600x to $450B in 10 yrs

- Home of stablecoins, DAOs, DeFi & NFTs

- Is 100x more growth still possible?

2️⃣ Regulations Heat Up

🇭🇰 Hong Kong stablecoin license race begins

🇺🇸 SEC approves spot ETF creation/redemption in-kind

- SEC’s “Project Crypto” aims to make the US a global crypto hub

3️⃣ Tokenized US Stocks Boom

- Robinhood Q2 crypto revenue surges

- Launches stock tokens in EU, staking in US

- Eyes dominance as Gen Z's “all-in-one finance app”

🌐 Tokenization = $500M market today

💥

1️⃣ Ethereum Turns 10

- $ETH grew 3600x to $450B in 10 yrs

- Home of stablecoins, DAOs, DeFi & NFTs

- Is 100x more growth still possible?

2️⃣ Regulations Heat Up

🇭🇰 Hong Kong stablecoin license race begins

🇺🇸 SEC approves spot ETF creation/redemption in-kind

- SEC’s “Project Crypto” aims to make the US a global crypto hub

3️⃣ Tokenized US Stocks Boom

- Robinhood Q2 crypto revenue surges

- Launches stock tokens in EU, staking in US

- Eyes dominance as Gen Z's “all-in-one finance app”

🌐 Tokenization = $500M market today

💥

- Reward

- like

- Comment

- Repost

- Share

🔻 Coinbase stock drops 9% post-earnings

In Q2, Coinbase posted $1.43B net profit—mostly from unrealized gains—but missed revenue expectations. Spot trading volume plunged 30%, and user activity fell sharply.

📉 $3.07B lost in user data leak

💰 Bought 2,509 BTC (now holds 11,776 BTC)

📉 Trading income down 39%

💼 Plans to expand into tokenized stocks & prediction markets

Full report reveals both strength and serious risks ahead.

#Crypto # Coinbase #Bitcoin # BTC #Base # Web3 #CryptoNews

In Q2, Coinbase posted $1.43B net profit—mostly from unrealized gains—but missed revenue expectations. Spot trading volume plunged 30%, and user activity fell sharply.

📉 $3.07B lost in user data leak

💰 Bought 2,509 BTC (now holds 11,776 BTC)

📉 Trading income down 39%

💼 Plans to expand into tokenized stocks & prediction markets

Full report reveals both strength and serious risks ahead.

#Crypto # Coinbase #Bitcoin # BTC #Base # Web3 #CryptoNews

- Reward

- like

- Comment

- Repost

- Share

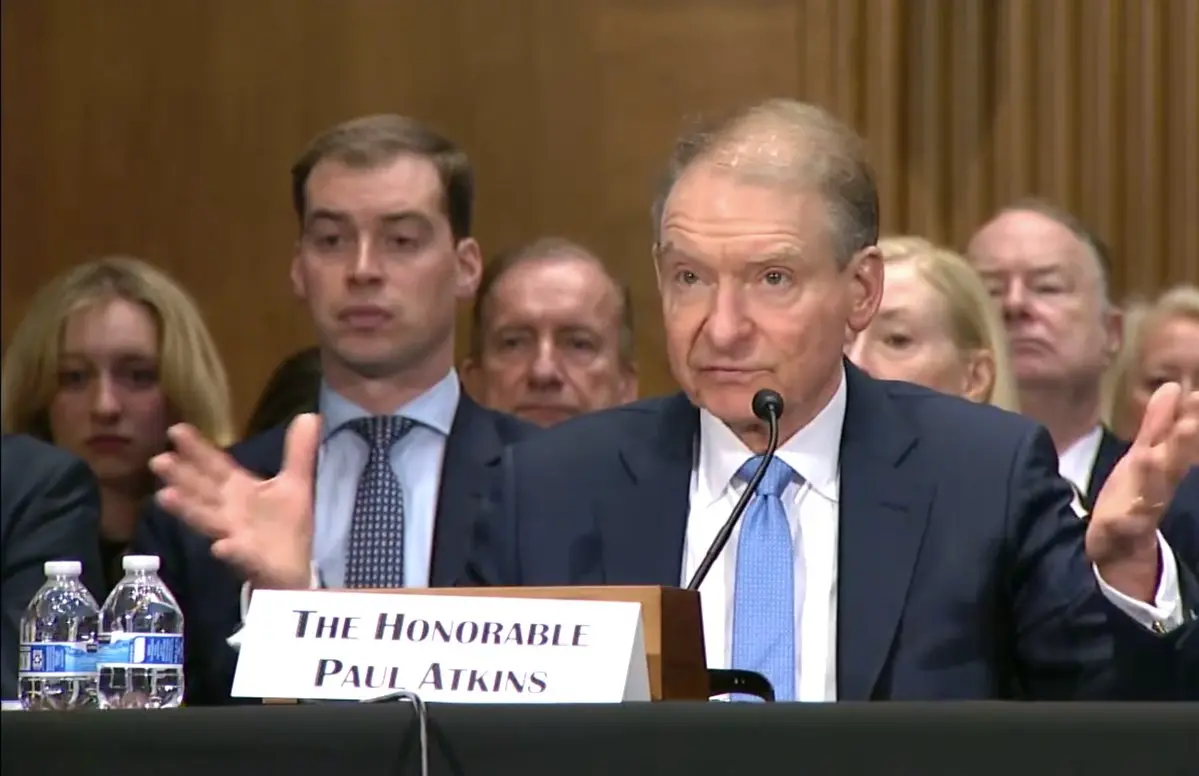

🇺🇸 SEC Launches “Project Crypto” – A New Era of Blockchain-Led U.S. Financial Leadership

In a historic speech on August 1st, SEC Chairman Paul S. Atkins announced the launch of “Project Crypto,” a comprehensive initiative to modernize U.S. securities regulations and migrate financial markets onto the blockchain.

🔹 The U.S. aims to become the global capital of digital assets, realizing President Trump’s vision.

🔹 The SEC will establish clear classification frameworks for both non-security digital assets (e.g., NFTs, stablecoins) and tokenized securities.

🔹 DeFi, self-custody wallets, decen

In a historic speech on August 1st, SEC Chairman Paul S. Atkins announced the launch of “Project Crypto,” a comprehensive initiative to modernize U.S. securities regulations and migrate financial markets onto the blockchain.

🔹 The U.S. aims to become the global capital of digital assets, realizing President Trump’s vision.

🔹 The SEC will establish clear classification frameworks for both non-security digital assets (e.g., NFTs, stablecoins) and tokenized securities.

🔹 DeFi, self-custody wallets, decen

- Reward

- like

- Comment

- Repost

- Share

🚨 Robinhood Q2 2025 Highlights: Crypto Surge Leads the Way 🚀

Robinhood reported $386M in net income (+105% YoY) on $989M in revenue (+45%). The star? Crypto trading revenue hit $160M, up 98% YoY, now making up nearly 30% of trading income.

🔹 Bitstamp acquisition added $7B in volume

🔹 Total crypto volume: $35B

🔹 Expanded to 30 EU countries

🔹 ETH & SOL staking live in US

🔹 “Robinhood Chain” under development

🔹 Eyeing WonderFi for Canadian expansion

Meanwhile, Gold subscriptions hit 3.5M, and assets under custody surged to $279B. Robinhood is becoming a serious force in global crypto + fi

Robinhood reported $386M in net income (+105% YoY) on $989M in revenue (+45%). The star? Crypto trading revenue hit $160M, up 98% YoY, now making up nearly 30% of trading income.

🔹 Bitstamp acquisition added $7B in volume

🔹 Total crypto volume: $35B

🔹 Expanded to 30 EU countries

🔹 ETH & SOL staking live in US

🔹 “Robinhood Chain” under development

🔹 Eyeing WonderFi for Canadian expansion

Meanwhile, Gold subscriptions hit 3.5M, and assets under custody surged to $279B. Robinhood is becoming a serious force in global crypto + fi

- Reward

- like

- Comment

- Repost

- Share

How to Make US Stocks Great Again? 🇺🇸📈

Imagine buying Apple, Tesla, or S&P500 stocks anytime, anywhere, with just a phone and crypto wallet — no brokers, no Wall Street hours.

That’s the promise of tokenized US stocks:

- On-chain stocks (ERC-20 style)

- 24/7 global trading

- Fractional ownership

- No geographical barriers

Big players like Robinhood, Ondo, Kraken, Backed Finance are already in the race. Even Figma’s IPO includes a blockchain-native stock class.

But challenges remain:

- Wild price swings due to low liquidity

- Legal grey zones

- SEC warns: “A tokenized stock is still a stock”

Imagine buying Apple, Tesla, or S&P500 stocks anytime, anywhere, with just a phone and crypto wallet — no brokers, no Wall Street hours.

That’s the promise of tokenized US stocks:

- On-chain stocks (ERC-20 style)

- 24/7 global trading

- Fractional ownership

- No geographical barriers

Big players like Robinhood, Ondo, Kraken, Backed Finance are already in the race. Even Figma’s IPO includes a blockchain-native stock class.

But challenges remain:

- Wild price swings due to low liquidity

- Legal grey zones

- SEC warns: “A tokenized stock is still a stock”

- Reward

- like

- Comment

- Repost

- Share

🚨 Bitcoin shrugs off $9.6B whale sell-off – $140K next?

Last weekend, an early BTC whale sold 80K BTC ($9.6B) via Galaxy Digital OTC. Price briefly dipped to $115K, then rebounded to $119K, showing strong market depth.

Unrealized profits hit a record $1.4T, with 97% of supply in profit.

Key range: $105K–$125K. A decisive breakout could push BTC to $141K, but on‑chain data suggests heavy profit‑taking pressure at that level.

This marks one of the largest realized profit events in BTC history, yet the market held near ATHs – a sign of maturity and strong liquidity.

#Bitcoin # BTC #Crypto

Last weekend, an early BTC whale sold 80K BTC ($9.6B) via Galaxy Digital OTC. Price briefly dipped to $115K, then rebounded to $119K, showing strong market depth.

Unrealized profits hit a record $1.4T, with 97% of supply in profit.

Key range: $105K–$125K. A decisive breakout could push BTC to $141K, but on‑chain data suggests heavy profit‑taking pressure at that level.

This marks one of the largest realized profit events in BTC history, yet the market held near ATHs – a sign of maturity and strong liquidity.

#Bitcoin # BTC #Crypto

BTC0.99%

- Reward

- like

- Comment

- Repost

- Share

🚨 Hong Kong’s stablecoin licensing regime starts Aug 1 – fierce race begins

HKMA’s final rules:

- 100% reserve backing & daily internal records

- Real‑name KYC, $3.2M+ paid‑up capital

- Applicants must engage by Aug 31, file by Sept 30

- Only single‑digit licenses expected in 1st batch

JD’s JCOIN/JOYCOIN names surface as contenders prepare. Stablecoins now face strict oversight, shifting from “crypto narrative” to regulated payment infrastructure.

Who will secure HK’s 1st licenses?

#HongKong # Stablecoin #Crypto

HKMA’s final rules:

- 100% reserve backing & daily internal records

- Real‑name KYC, $3.2M+ paid‑up capital

- Applicants must engage by Aug 31, file by Sept 30

- Only single‑digit licenses expected in 1st batch

JD’s JCOIN/JOYCOIN names surface as contenders prepare. Stablecoins now face strict oversight, shifting from “crypto narrative” to regulated payment infrastructure.

Who will secure HK’s 1st licenses?

#HongKong # Stablecoin #Crypto

BATCH-1.43%

- Reward

- like

- Comment

- Repost

- Share